Streamlining Onboarding with Employee Tax Software in the US

In recent years, the complexity of employee tax forms in the United States has surged, prompting the widespread adoption of employee tax software to simplify and automate the entire process. Initially embraced by large enterprises, digital form templates and software for employee taxes are now utilized by businesses of all sizes, from small startups to major corporations. This article explores how American companies can leverage tax software and digital form templates to save time, reduce paperwork, and enhance efficiency when filing employee taxes.

Key Topics:

- What is Employee Tax Software?

- Step-by-Step Guide: Using BIStrainer’s Digital Forms Module for W-2 Employee Forms

- Choosing the Right Employee Tax Software for the U.S.

- Using Other Employee Tax Software Solutions in the U.S.

What is Employee Tax Software?

Employee tax software, also known as payroll tax software or payroll software, is a type of application designed to assist businesses in managing and processing their employees’ payroll and tax-related tasks. These software solutions automate various aspects of payroll processing, including calculating wages, withholding taxes, and generating paychecks.

The popularity of employee tax software in the United States can be attributed to several factors:

- Complex Tax Regulations: The U.S. tax code is complex and subject to frequent changes. Employee tax software helps businesses stay compliant with federal, state, and local tax regulations by automating calculations and ensuring accurate withholding.

- Time and Cost Savings: Manual payroll processing is time-consuming and prone to errors. Employee tax software streamlines the payroll process, saving time for businesses and reducing the likelihood of costly mistakes. This allows organizations to focus on other aspects of their operations.

- Efficiency and Accuracy: Payroll software automates calculations, reducing the chances of human error. This results in accurate and consistent payroll processing, helping businesses avoid penalties and fines associated with payroll mistakes.

- Accessibility and Convenience: Cloud-based employee tax software allows businesses to access payroll information from anywhere with an internet connection. This is especially beneficial for remote work scenarios and businesses with multiple locations.

- Integration with Accounting Software: Many employee tax software solutions integrate seamlessly with accounting software, providing a holistic view of financial data. This integration streamlines the overall financial management process for businesses.

- Employee Self-Service: Some payroll software solutions offer employee self-service portals, allowing employees to access their pay stubs, tax documents, and other relevant information. This reduces the burden on HR departments and enhances transparency.

- Automatic Updates: Payroll software often includes automatic updates to ensure compliance with changing tax laws and regulations. This feature helps businesses stay current without manual intervention.

- Scalability: Employee tax software is designed to accommodate the growth of businesses. As companies expand and hire more employees, the software can often scale to meet increased payroll demands.

In summary, the popularity of employee tax software in the United States is driven by the need for efficiency, accuracy, compliance with complex tax regulations, and the desire to streamline payroll processes to save time and resources. The benefits of these software solutions make them valuable tools for businesses of all sizes.

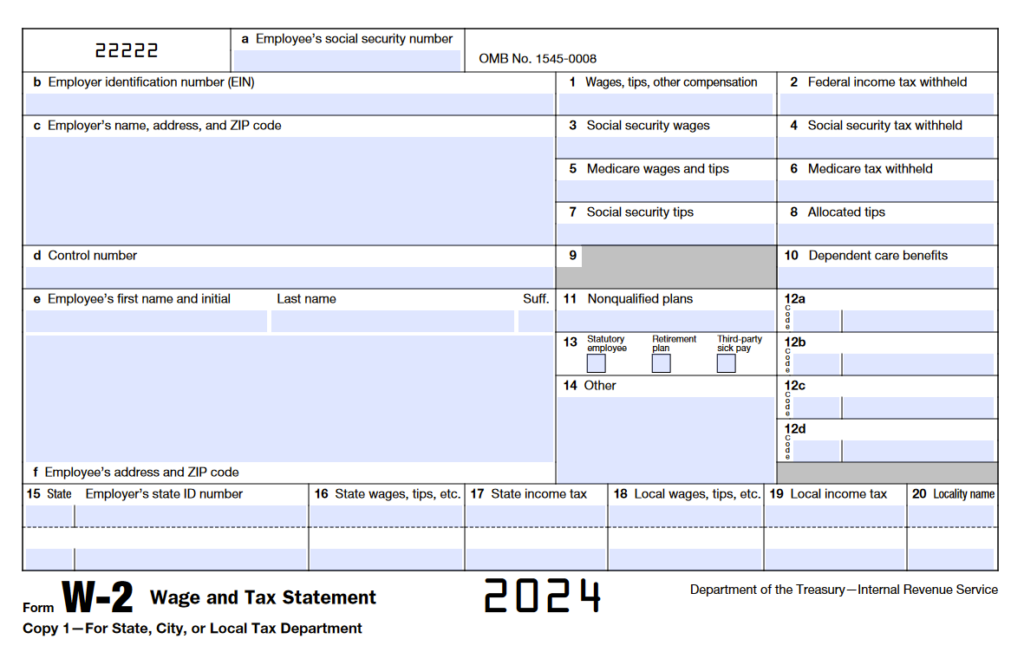

Step-by-Step Guide: Using BIStrainer’s Digital Forms Module for W-2 Employee Forms

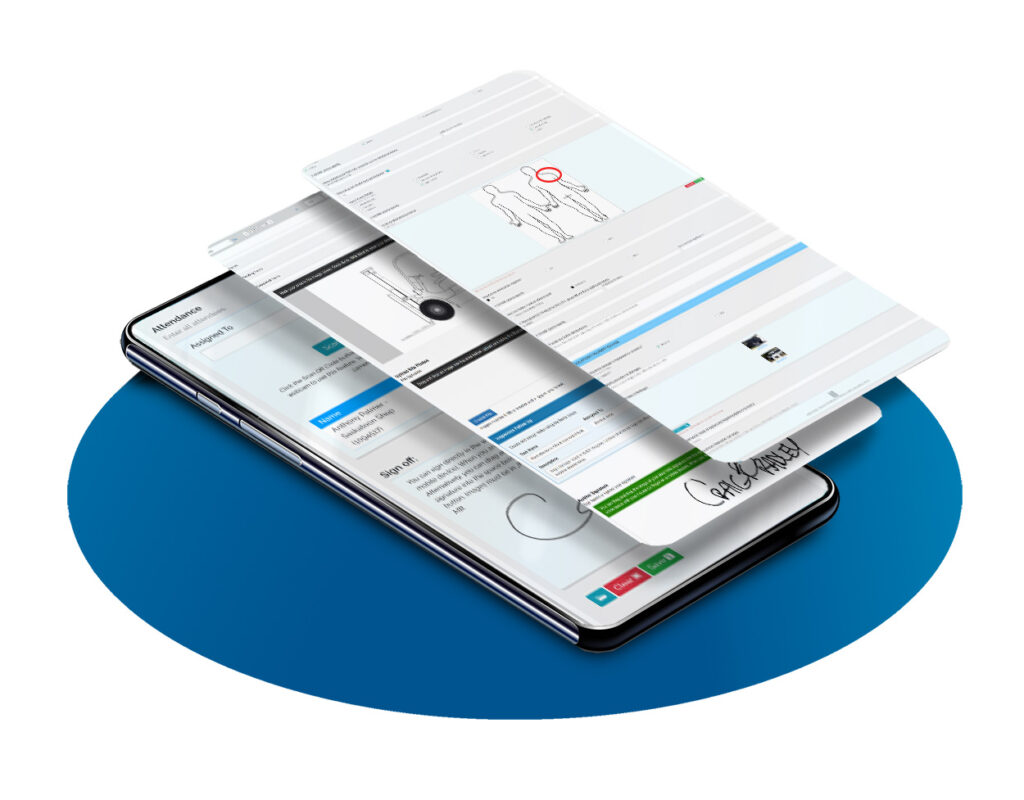

BIStrainer, a comprehensive digital training and compliance management platform, includes a robust Digital Forms Module to streamline various processes, including W-2 employee forms. Follow these steps to efficiently manage and fill out W-2 forms using BIStrainer’s Digital Forms Module. For this you will need access to a BIStrainer account and with the digital forms feature unlocked

Step 1: Accessing the Digital Forms Module

- Log in to your BIStrainer account.

- Navigate to the “Digital Forms” section, located in the admin dashboard or the designated forms module.

Step 2: Creating a New W-2 Form Template

- Click on “Create New Form” within the Digital Forms Module. Use the actual W2 for reference.

- Now populate with any widget you need like the personal information widget which will automatically fill in the employees’ info when selected.

Step 3: Automation of Calculations

- Leverage the automation features within BIStrainer to handle complex tax calculations automatically. This ensures accuracy and reduces the risk of errors.

Step 5: Customization for Specific Needs

- Customize the your W-2 form based on the unique needs of your organization. BIStrainer allows for flexibility in adapting the digital forms to handle specific data points and generate tailored reports.

Step 6: Onboarding Efficiency

- Implement the digital W-2 forms as part of your onboarding process to capitalize on efficiency gains. According to industry insights, organizations using digital tax document forms report significant reductions in onboarding time.

Step 7: Save, Review, and Submit

- Save the completed W-2 forms securely within the BIStrainer platform.

- Review the forms for accuracy before final submission.

By following these steps within BIStrainer’s Digital Forms Module, you can enhance the efficiency, accuracy, and compliance of your W-2 employee forms, contributing to a streamlined and modernized approach to tax document management. Furthermore, this BIStrainer integration allows you to merge your health and safety with your onboarding giving you access to your employees’ training records and safety documents along with speeding up the tax process.

Choosing the Right Employee Tax Software for the U.S.

Selecting the appropriate software for U.S. employee tax forms is crucial. The software should seamlessly integrate with existing HR systems, ensuring a smooth data flow and minimizing the risk of errors. Automation capabilities are essential for accurate tax calculations, freeing up HR professionals to focus on strategic tasks. Additionally, the software should provide compliance updates to navigate the ever-evolving U.S. tax laws successfully.

Navigating the U.S. Tax Landscape

The U.S. tax regulations are as diverse as the geographical landscapes across the nation. Dealing with the multitude of forms required for each employee can be overwhelming. Traditional methods of manual compilation, such as processing W-2s and other tax-related forms, are time-consuming and prone to errors.

The Challenge of Traditional Methods in the U.S.

HR professionals in the U.S. traditionally faced challenges in manually compiling W-2s and other tax-related forms. The meticulous process of gathering data, performing calculations, and ensuring compliance with evolving tax laws can be daunting.

Using Other Employee Tax Software Solutions in the U.S.

As the complexity of employee tax forms in the United States continues to grow, the adoption of digital form software has become imperative for companies aiming to streamline processes, enhance accuracy, and comply with evolving tax regulations. In this guide, we delve into the specific methods and benefits of using digital form software, with a focus on filling out W-2 forms.

1. Understanding the Need for Digital Solutions:

The U.S. tax landscape is intricate, with each employee requiring multiple forms, including the crucial W-2. Manual methods of handling tax forms are prone to errors, time-consuming, and may lead to compliance issues. Digital form software addresses these challenges by automating calculations, ensuring compliance, and providing a centralized platform for efficient management.

2. Selecting the Right Software:

Choosing the appropriate digital form software is paramount. Look for solutions that seamlessly integrate with existing HR systems, offering a cohesive workflow. Prioritize automation features that can handle complex calculations, reducing the burden on HR professionals. Ensure the software stays up-to-date with the ever-changing U.S. tax laws, guaranteeing compliance.

3. The W-2 Filing Process with Generic Software:

When it comes to filling out W-2 forms, digital software simplifies the entire process. Here’s a step-by-step guide:

- Data Input: Input employee information into the software, including personal details, wages, and tax withholdings. Many software solutions allow for bulk data upload, minimizing manual entry.

- Calculation Automation: Let the software handle the intricate calculations required for tax withholdings, ensuring accuracy and reducing the likelihood of errors.

- Compliance Checks: Digital form software should include features that automatically check for compliance with current U.S. tax laws. This proactive approach mitigates the risk of non-compliance.

- Electronic Filing: Most digital solutions enable electronic filing of W-2 forms, streamlining the submission process. This not only saves time but also aligns with the IRS’s preference for electronic submissions.

4. Enhancing Efficiency in Onboarding:

The transition to digital forms significantly impacts the onboarding process. According to industry insights, companies utilizing digital tax document forms report a substantial reduction in onboarding time, contributing to a positive first impression for new hires.

5. Ensuring User-Friendly Interfaces:

To maximize efficiency, prioritize digital form software with user-friendly interfaces. Navigating through the system should be intuitive, reducing the learning curve for HR professionals and ensuring swift adaptation.

6. Customization for Unique Needs:

Recognizing that every organization has unique requirements, seek software solutions that offer customization options. Tailoring the software to handle specific data points and generate custom reports enhances its utility for HR teams.

Factors to Consider in the U.S.

When selecting digital forms or software for U.S. employee tax filing, it’s crucial to consider factors such as seamless integration with existing systems, automation for accuracy, compliance updates, a user-friendly interface, customization options, and easy onboarding processes.

Enhancing Onboarding Efficiency in the U.S.

Embracing digital forms for employee tax documents is a pivotal step in modernizing onboarding processes in the U.S. According to a recent survey by HR Tech Insights, organizations transitioning to digital tax document forms reported a significant 40% reduction in onboarding time. This shift expedites tax-related information collection, minimizes errors, and ensures a smoother onboarding experience for HR professionals and new hires alike.